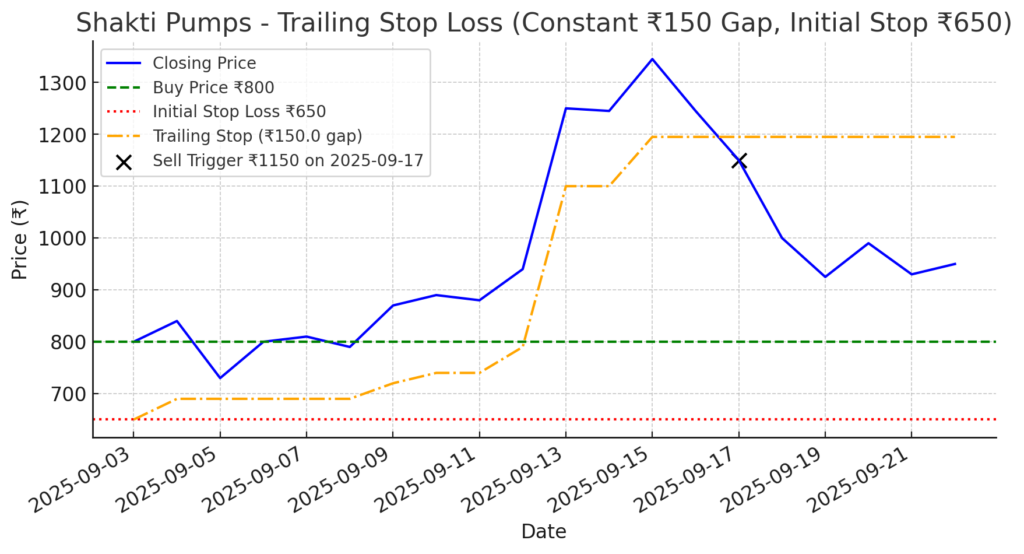

Key

- 🔵 Blue line – Stock Price (Fictitious Shakti Pumps trend)

- 🟠 Orange line – Trailing Stop Loss (moves upward dynamically)

- 🟥 Red line – Initial Stop Loss (₹650)

- ⚫ Black marker – Sell Trigger Point (₹1,150 on 17 Sept 2025)

When it comes to trading or investing, one of the biggest challenges isn’t just picking the right stock — it’s knowing when to sell. Exiting too early can cap your gains, while holding too long can turn a winning position into a loss.

That’s where a trailing stop loss comes in.

A trailing stop loss is a dynamic exit strategy that moves up as the price of a stock rises, allowing you to protect profits without manually adjusting your stop every day. Unlike a fixed stop loss (which stays at one price), a trailing stop “trails” the market upward but never moves down.

How a Trailing Stop Works

Let’s start with the basics.

- Buy Price: The price at which you enter the stock.

- Initial Stop Loss: A safety net below your buy price to limit potential loss.

- Trailing Stop Loss: A moving stop that follows the stock’s highest price at a fixed gap or percentage.

If the stock rises, the trailing stop rises proportionally.

If the stock falls, the trailing stop remains where it is — and when the price crosses below it, the position is automatically (or manually) sold.

Understanding the Example

(Note: All figures and prices in this example are entirely fictitious and are used only for educational understanding.)

Let’s assume you bought Shakti Pumps at ₹800 per share and set an initial stop loss at ₹650, creating a ₹150 trailing gap.

This means your stop loss would always remain ₹150 below the highest price the stock has reached since your purchase.

How the Trailing Stop Adjusted

| Stage | Stock Price | Trailing Stop | Comment |

|---|---|---|---|

| Entry | ₹800 | ₹650 | Buy initiated with initial stop loss |

| Stock Rises | ₹1,300 | ₹1,150 | Trailing stop moves up dynamically (highest price – ₹150) |

| Stock Falls | ₹1,150 → ₹900 | ₹1,150 | Price dips below trailing stop → Sell Triggered |

The trailing stop loss system locked in profits automatically — no need for manual intervention or emotional decision-making.

When the price fell below ₹1,150, the sell condition was triggered, ensuring you exited with gains instead of watching profits erode.

Why Trailing Stops Matter

A trailing stop loss is a smart exit strategy that evolves with the market:

- It protects profits when the stock moves upward.

- It locks gains by raising the stop as new highs are made.

- It prevents emotional decisions — you don’t have to watch prices all day.

The wider ₹150 gap in this example provided more flexibility, allowing the stock to fluctuate before triggering a sale. A tighter stop would have exited earlier but captured smaller gains.

Key Takeaways

- Dynamic Safety Net – The stop loss trails the highest price by a fixed amount or percentage.

- No Manual Tracking – Once set, it automatically updates as price moves up.

- Protects Profits, Limits Losses – Locks in upside, controls downside.

- Wider Gaps = More Flexibility – Broader trailing gaps reduce premature exits.

- Best for Trending Stocks – Works great in upward-moving markets.

In Summary

This Shakti Pumps example shows how a trailing stop loss at a constant ₹150 gap can protect profits while letting the stock breathe.

When the price finally fell below the trailing level, the system sold automatically at ₹1,150 — turning volatility into disciplined profit-taking.