1. What is the P/E (Price-to-Earnings) Ratio?

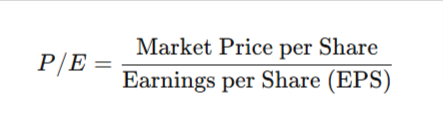

The Price-to-Earnings Ratio is a financial metric used to evaluate the valuation of a company’s stock. It compares the current market price of the stock to the company’s earnings per share (EPS).

Formula:

Key Points about P/E:

- Interpretation:

- A high P/E ratio may indicate that investors expect future growth or that the stock is overvalued.

- A low P/E ratio could suggest the stock is undervalued or that the company is struggling.

- Industry Variations:

- Different industries have varying average P/E ratios. For example, tech companies often have higher P/E ratios than utility companies.

- Use Case:

- It is widely used to compare companies within the same industry.

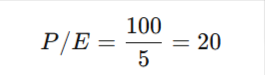

Example:

If a stock is priced at ₹100 and its EPS is ₹5, the P/E ratio is:

This means investors are willing to pay ₹20 for every ₹1 of earnings.

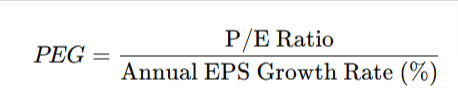

2. What is the PEG (Price/Earnings-to-Growth) Ratio?

The PEG Ratio improves upon the P/E ratio by incorporating a company’s earnings growth rate into the valuation metric. It helps determine whether a stock is overvalued or undervalued relative to its growth.

Formula:P

Key Points about PEG:

- Interpretation:

- A PEG ratio of 1 indicates fair value.

- A PEG ratio less than 1 suggests the stock may be undervalued.

- A PEG ratio greater than 1 indicates the stock may be overvalued.

- Growth Focus:

- PEG considers the growth aspect, which makes it particularly useful for evaluating growth stocks.

- Use Case:

- It is ideal for comparing companies with high growth potential, like startups or tech firms.

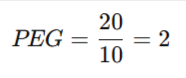

Example:

If a company has a P/E ratio of 20 and an EPS growth rate of 10%, the PEG ratio is:

This implies the stock may be overvalued relative to its growth rate.

3. Comparison: P/E vs PEG

| Feature | P/E Ratio | PEG Ratio |

|---|---|---|

| Definition | Compares stock price to EPS. | Adjusts P/E ratio by accounting for growth. |

| Formula | Price Per Share / EPS | PE Ratio / EPS Growth Rate (%) |

| Focus | Focuses on past or current performance. | Focuses on future growth potential. |

| Usage | Used to compare companies within the same industry. | Ideal for evaluating growth stocks. |

| Limitations | Doesn’t account for growth. | Assumes growth projections are accurate. |

| Interpretation | High P/E = Expensive, Low P/E = Cheap. | PEG < 1 = Undervalued, PEG > 1 = Overvalued. |

| Ideal Use Case | Mature industries or stable companies. | High-growth industries like tech. |

4. How to Rely on Them?

- P/E Ratio:

- Suitable for mature companies with consistent earnings.

- Compare only within the same sector, as P/E varies by industry.

- Use in conjunction with other metrics to avoid misleading conclusions.

- PEG Ratio:

- Best for high-growth companies.

- Helps identify stocks that may appear expensive on P/E but are justified by strong growth prospects.

- Evaluate the reliability of growth projections, as PEG depends heavily on growth estimates.

5. Examples and What to Expect:

| Metric | Company A | Company B | What to Expect |

|---|---|---|---|

| P/E Ratio | 30 | 10 | Company A is more expensive per ₹1 of earnings. |

| EPS Growth Rate (Annual %) | 20% | 5% | Company A has higher growth potential. |

| PEG Ratio | 1.5 | 2.0 | Company A is relatively cheaper. |

| Conclusion | Fairly Valued | Overvalued | Company A may be a better growth investment. |

6. Real-World Scenarios:

- Low P/E but High Growth (PEG < 1):

- Stock is undervalued and has strong growth potential.

- High P/E and Low Growth (PEG > 1):

- Stock is likely overvalued.

- High P/E and High Growth:

- Could be justified if PEG is around 1.

- Low P/E and Low Growth:

- May indicate a value trap; investigate further.

7. Key Takeaways:

- Use P/E ratio for stable companies and industries.

- Use PEG ratio for high-growth sectors.

- Avoid relying solely on either metric; always consider additional factors like debt levels, cash flow, and market conditions.